Early Investors & Tax Incentives

Considering investment opportunities for innovative Australian start-up companies?

In December 2015, the Turnbull Government announced the National Innovation and Science Agenda, introducing new tax incentives for early stage investors in innovative Australian companies. The legislation was passed by the Australian Parliament in early May 2016.

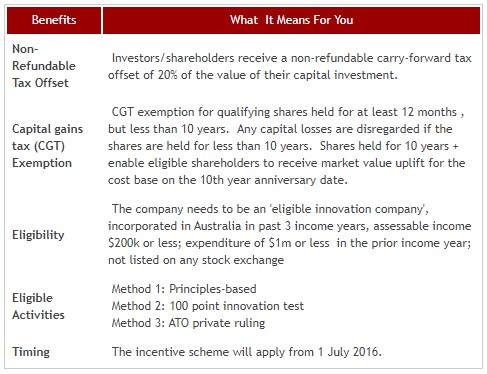

The tax incentives are to provide concessional tax treatment for investors through non-refundable tax offset and a capital gains tax (CGT) exemption, provided investors meet certain eligibility criteria.

An incentive to support start-ups

Australian start-ups have long lamented the lack of start-up funding and early investment, often championing a US-style venture capital culture as a solution to the funding needs innovative companies have in the early stages of development or growth.

With innovation a large plank of Prime Minister Turnbull’s economic growth strategy, the incentives have been broadly welcomed.

However, what does the opportunity and benefit for early investors actually look like?

What is the incentive for investors?

Investors would benefit from paying no capital gain from shares in start-up innovation companies where the shares have been held for 1-10 years, with the ability to claim a non-refundable tax offset of 20% of the value of their investment.

The maximum for the offset is $200,000.

Which companies can investors target for potential investment?

The eligibility criteria for the incentives is fairly rigid, as the start-up (innovative) company needs to meet certain qualifying conditions.

Eligibility Criteria: What are the conditions?

- Method 1: Principles-based

- Method 2: 100 point innovation test

- Method 3: ATO private ruling

What should you do next?

Contact Bates Cosgrave on 02 9957 4033 for more information about the early investor legislation and how it may benefit either the growth of your innovative company – or open up opportunities for investment in companies that are developing innovative commercialisation projects.

For more information, please contact us on 02 9957 4033 to discuss your eligibility.

Last updated July 2016. This factsheet is provided for information purposes only and is correct at the time of publishing. It should not be used in place of advice from your accountant. Please contact us on 02 9957 4033 to discuss your specific circumstances.